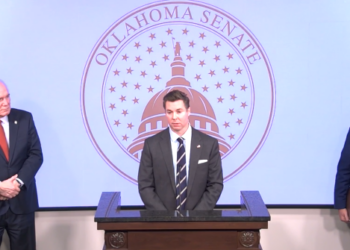

OKLAHOMA CITY (OBV) – Oklahoma House of Representatives Speaker Charles McCall has put forth several tax cut bills, many of which are focused on reducing personal income tax.

McCall, R-Atoka, filed five bills for the upcoming legislative session that seek to reduce taxes in Oklahoma.

The 59th Oklahoma Legislature convenes in exactly one month, Monday, Feb. 5.

“Everyday Oklahomans continue to feel the effects of destructive federal economic policies on their wallet, and they desperately need relief,” McCall said. “The House has passed numerous tax cut bills to the Senate during multiple regular and special sessions throughout the last three years, and these new bills represent our latest attempt to get meaningful tax cuts passed and to the governor’s desk. Our state is in a strong position both economically and in regards to savings, so now is the perfect time to pass tax cuts and let the citizens of Oklahoma keep more of their hard-earned money.”

McCall filed the following tax cut bills:

- HB 2948 – Corporate income tax phase out over five years.

- HB 2949 – Flat rate 4.25% personal income tax effective Jan. 1, 2024; rate imposed on taxable income amounts above specific figures based on filing status.

- HB 2950 – .25% personal income tax decrease effective Jan. 1, 2024, and following tax years.

- HB 2951 – .25% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

- HB 2952 – .50% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

Tax cut legislation that was passed by the House during the 58th Oklahoma Legislature but is still awaiting Senate action is as follows:

- HB 1953 – As amended – eliminates the current standard deductions and changes the personal income taxing framework from a bracket based system to a flat rate system. For tax year 2024 and 2025, sets the flat rate at 4.25%, with the rate imposed on taxable income amounts above specific figures based on filing status.

- HB 1954 – .50% personal income tax decrease effective Jan. 1, 2024, and following tax years.

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers.

Some tax bills passed during the 58th Legislature did become law, including a bill that eliminates the franchise tax, a bill that allows full expensing of capital investments for businesses and a bill that eliminates the marriage penalty within the state’s individual income tax.