ALTUS, Okla. (OBV) – The State Chamber hit the road on Thursday to present ChamberCare to members of the Altus Chamber of Commerce, informing small business owners about the advantages of signing up for the new self-funded health care option.

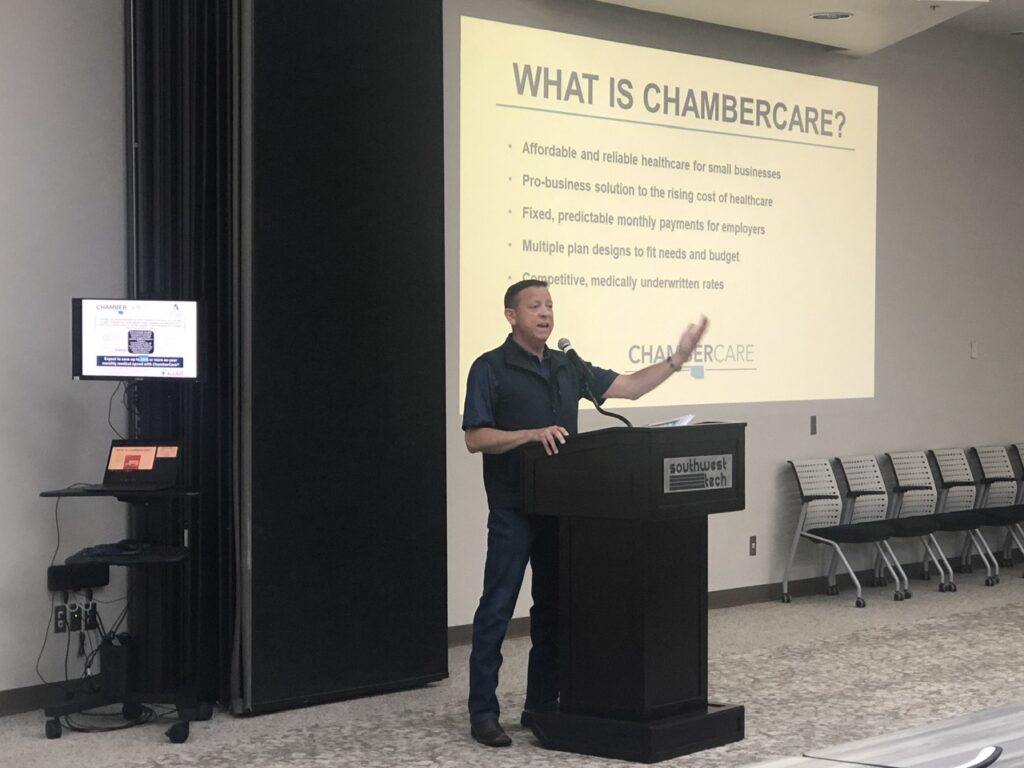

ChamberCare became a licensed health insurance provider in August, and The State Chamber held an official launch celebration last Wednesday. Chamber officials carried the momentum to Altus the following day for the presentation at Southwest Technology Center.

Several small business owners attended the presentation, which was hosted by the Altus Chamber of Commerce.

The Altus Chamber is one of several local chambers across the state that is partnering with The State Chamber in offering ChamberCare to their members.

“It was actually something we have been looking into – trying to come up with a plan ourselves here locally,” said Altus Chamber President & CEO Jenny Graves.

Graves said The State Chamber contacted her about ChamberCare when she and her team were on the verge of giving up their search for a health plan to provide to their members.

“We were super excited and so are our members,” Graves said.

ChamberCare is administered by Allied and utilizes the Aetna Signature Administrators health insurance network. It is available to small businesses that have two to 50 employees.

The Chamber created ChamberCare to provide small businesses a cost-saving health insurance plan that diverges from the rising cost of healthcare.

“The Chamber’s mission is to make Oklahoma the best place in the country to do business. Providing ChamberCare as an option for small businesses is a way to make that a reality,” said State Chamber President and CEO Chad Warmington.

Kelly Wolf, an account executive for Consoliplex, a healthcare management company that makes health care challenges simpler for small businesses, told Oklahoma Business Voice last week that businesses that sign up for ChamberCare will save 20-30 percent on their health insurance premiums.

The Altus Chamber has around 250 members, about half of which are businesses with two to 50 employees. Most of those small businesses need an affordable health care option to provide to their employees, according to Graves.

“A lot of members have different wants and needs, but all of them want to cut cost, and they’d like to save money,” Graves said. “And a lot of them have not been able to provide insurance to their employees before now. So, we’re hoping this will be a way for them to do so.”

Jessie Rodriguez, the owner of J.E.D’S Home Services, attended the presentation. Rodriguez has been a one-man handyman operation since he started his business two years ago, but is looking to expand his business to include a painting service and a junk-hauling service. He said he wants to have a medical plan option for the staff he will inevitably hire as part of the expansion.

“My first step is coming and getting information, just seeing what to look for,” Rodriguez said.

Rodriguez said he wants to hire individuals with specialized, reliable skills and that he will want for them to be insured.

“It’s something that I would encourage them to be involved in,” Rodriguez said.

David Morgan with Summit Financial, an independent Oklahoma-based insurance broker, participated in the presentation, answering questions from Rodriguez and other small business owners about ChamberCare coverage.

“This is a self-funded plan,” Morgan said. “Self-funded means the employer doesn’t want to send all this money – premiums – to Blue Cross every year. So, people come together and become self-funded.”

Payments from individuals who sign up for ChamberCare will go into a fund that will pay for the insurance claims.

Morgan described ChamberCare as a pro-business plan with fixed pricing.

“The goal of this is to reduce the cost of health premiums,” Morgan said.

The State Chamber modeled ChamberCare after successful plans launched by other chambers in the past. Chamber officials extensively researched whether there was a market in Oklahoma for a self-funded health care option oriented to small businesses, according to Carla Schaeperkoetter, chief operating officer of The State Chamber.

In addition to the two-to-50 employee requirement, a business must be in good standing as members of a local chamber of commerce that is authorized to offer ChamberCare.

The following chambers have partnered with The State Chamber in offering ChamberCare to their business members:

- Altus Chamber of Commerce

- Ardmore Chamber of Commerce

- Cushing Chamber of Commerce

- Del City Chamber of Commerce

- Duncan Chamber of Commerce

- Edmond Area Chamber of Commerce

- Elk City Chamber of Commerce

- Guymon Chamber of Commerce

- Lawton Fort Sill Chamber of Commerce

- Moore Chamber of Commerce

- Norman Chamber of Commerce

- Pryor Chamber of Commerce

Small business owners across Oklahoma need an affordable health insurance option that will benefit their employees, according to Warmington.

“By being able to provide affordable quality coverage for their employees, its a huge game changer for Oklahoma small businesses. And that’s what we’re here for,” Warmington said. “We’re here for to do whatever we can do to make Oklahoma the best state in the nation for businesses.”

Go to The State Chamber website to learn more about ChamberCare.