OKLAHOMA CITY (OBV) – Oklahoma is becoming more tax competitive, having risen in the Tax Foundation’s national ranking.

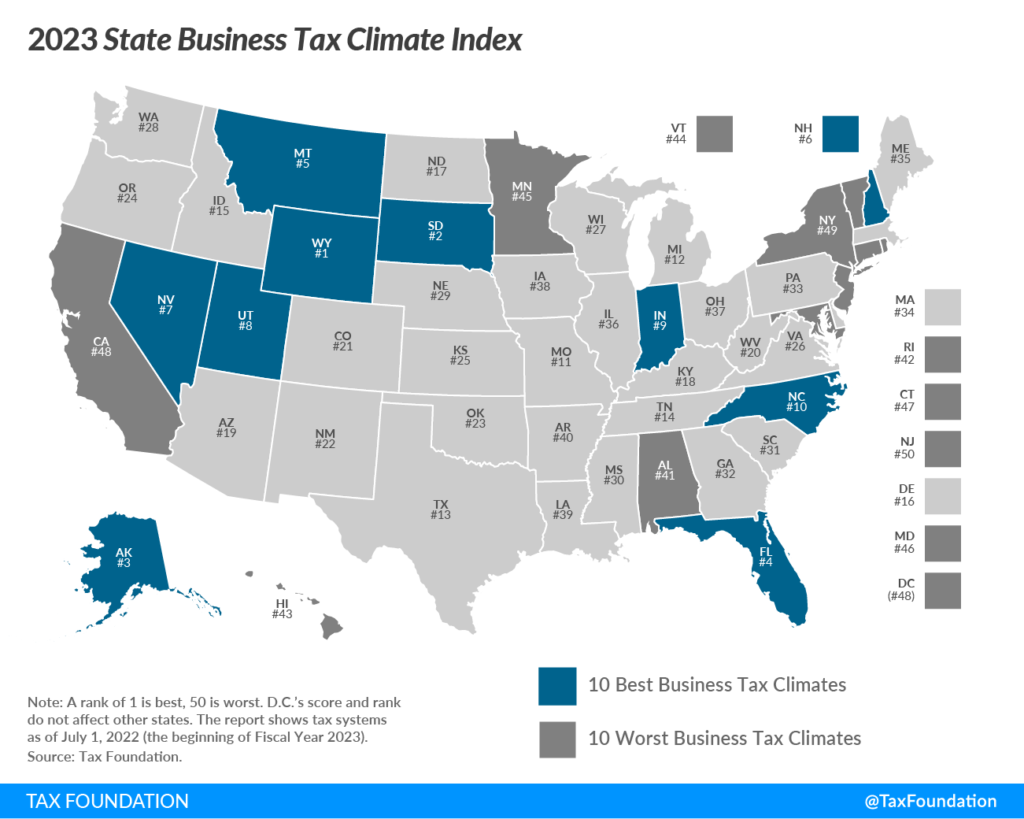

The Tax Foundation’s 2023 Business Tax Climate Index shows that Oklahoma rose to 23rd in its ranking of states with the best business tax climate in the nation.

It’s an improvement from another recently released ranking.

The State Chamber Research Foundation released its 2022 Oklahoma Scorecard in October and ranked the Sooner State as 26th in tax competitiveness.

“The Oklahoma legislature and business community has done good work to make our state more tax competitive, but there is still room for improvement,” said Chad Warmington, President and CEO of The State Chamber. “We have to continue to push for more tax reform to ensure Oklahoma reaches its fullest competitive potential. We need to grow our economy so our state can become an even better place to live, work and raise a family.”

Oklahoma has made steady strides in tax competitiveness. The Scorecard ranked Oklahoma 30th in the nation in 2021.

Ben Lepak, SCRF executive director, said Oklahoma climbed four spots from 2021 to 2022 largely because of previous and individual income tax rate cuts coming online. He said the state can continue improving in tax competitiveness by simplifying the individual income tax structure and restructuring property taxes.

Efforts are underway in the State Legislature to modernize Oklahoma’s individual income tax.

House Bill 2285 aims to modify individual income tax through the following changes:

- Consolidating six tax brackets into one;

- Increasing the standard deduction to ensure no increased tax liability on low-income filers;

- Reducing the current rate from 4.75 percent to 4.5 percent;

- Putting sound triggers in place for future rate cuts, only if conditions permit.

The Tax Foundation listed Wyoming as the best tax climate state, followed by South Dakota, Alaska, Florida and Montana.

“The absence of a major tax is a common factor among many of the top 10 states,” the Tax Foundation website states. “Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax.”

New Jersey was ranked the worst tax climate state, followed by New York, California, Connecticut and Maryland.

Tax Foundation personnel said the lowest-ranking tax climate states have a common affliction: complex, nonneutral taxes with comparatively high rates, including high property, corporate income and individual income tax rates.