OKLAHOMA CITY (OBV) – A bill that aims to eliminate Oklahoma’s franchise tax succeeded in the state’s House of Representatives this week.

The Oklahoma House of Representatives passed House Bill 2695 with a vote of 78 to 19.

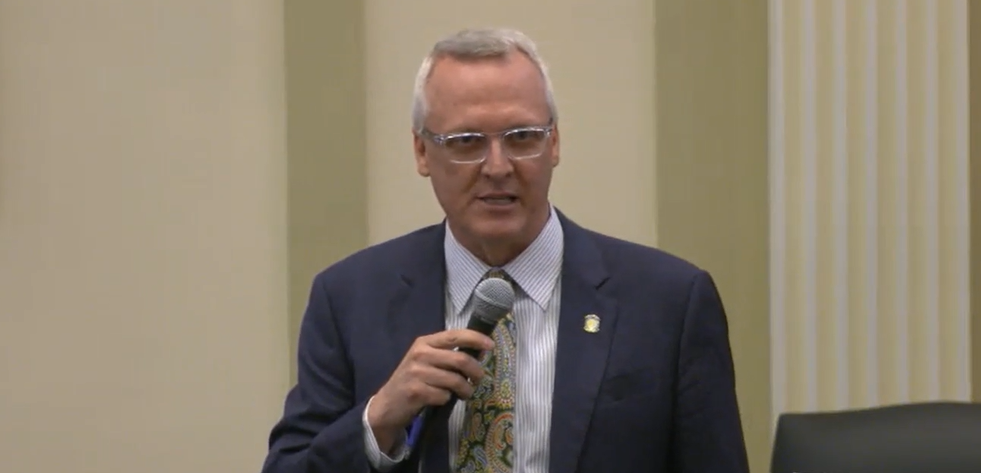

HB 2695, written by Rep. Gerrid Kendrix, R-Altus, proposes to eliminate the franchise tax, as well as requirements to file a franchise tax return.

The state’s franchise tax is a direct tax levied on a company’s net worth, taxing $1.25 for every $1,000 in capital, with the amount capped at $20,000, regardless of the company’s size or net worth.

“It’s a tax on investment in the state, not on income. It’s based on the entity’s structure and not on the operation of the business,” Kendrix said on the House floor. “Our goal is to be better regardless of where we are ranked. I believe this is one of those things that assists with that.”

Fourteen states, including Oklahoma, have the franchise tax. Mississippi and Connecticut are both in the process of phasing out their franchise tax.

Out of the 400,000 plus businesses in the state, only around 70,000 businesses pay a franchise tax, according to information from The State Chamber Research Foundation.

HB 2695 now moves to the Oklahoma Senate.