Note: This story has been updated to provide more detailed figures on the authorized funds that were certified by the Oklahoma State Board of Equalization.

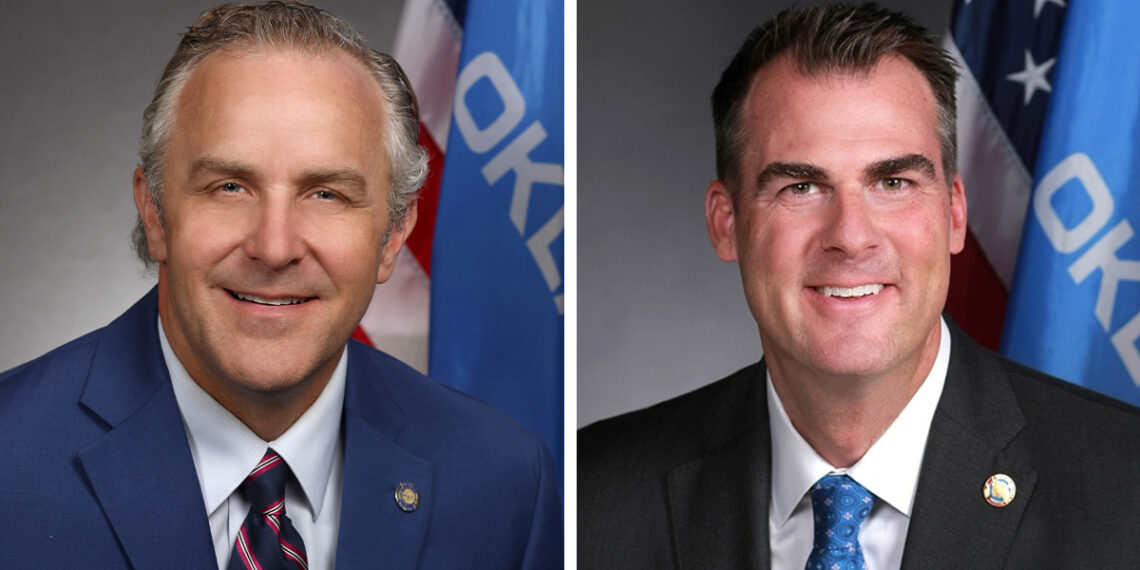

OKLAHOMA CITY (OBV) – Gov. Kevin Stitt and Senate President Pro Tempore Greg Treat are slightly differing on tax cut priorities after the Oklahoma State Board of Equalization certified that the State Legislature has billions of dollars in authorized funds for Fiscal Year 2025.

Stitt has been pushing for income tax cuts, even calling two special sessions – one in September, one before the start of the 59th Legislature. He called once again for tax cuts on Thursday after the authorized funds were announced.

The Board of Equalization certified $13.9 billion in authorized funds, including $11.1 billion in reoccurring funds and $2.8 billion in one-time funds.

The governor released the following statement stressing the need for tax cuts:

“It’s no accident Oklahoma has record-breaking state savings, higher than expected revenue, and an objectively strong fiscal outlook from three of the nation’s top credit agencies. These accomplishments are the result of our conservative approach to governance, and every Oklahoman will benefit once the Legislature cuts their taxes and delivers a pay raise.

Oklahomans are already asking: ‘How much money does the state need?’ Make no mistake, today’s news from the Board of Equalization is not an invitation for the Legislature to spend all $11.1 billion. We must continue to practice fiscal conservatism by returning excess revenue back to Oklahomans in the form of tax cuts.

Oklahomans have waited long enough for a pay raise and for relief at the grocery store. It’s reassuring to see legislation in both chambers. There are no more excuses, let’s get those passed. I’m ready to sign any tax cut that comes to my desk.”

Gov. Kevin Stitt

Treat also spoke about the need for a tax cut, stressing the importance of being “sober-minded,” saying that both a grocery tax cut and income tax cut should not be pursued in the same year. He released the following statement:

“These numbers are certainly encouraging, and they show a lot of promise,” Pro Tem Treat said. “With these numbers and the current savings we have, now is the time to cut the grocery tax. Cutting the grocery tax will give Oklahomans immediate relief every time they leave the grocery store and will be more beneficial than any other form of tax cut.

While the certified numbers are positive, we must be sober-minded and realize we cannot have both a grocery tax cut and an income tax cut this year. I appreciate the prudence and fiscal conservatism of my Senate colleagues, who over the years have prioritized spending and savings and have put a stop to nonsensical ideas that would lead our state in the wrong direction. Without our measured approach, we would not be in this position today.”

Pro Tem Greg Treat

Treat has clashed with Stitt over tax cuts, having adjourned the Senate on the first day of the last two special sessions. He said both times that it would be irresponsible to pass tax cuts before knowing how much in authorized funds the legislature would have.

The push for tax cuts in the 59th Legislature began earlier this month when House Speaker Charles McCall, R-Atoka, filed several tax cut bills. Those bills are as follows:

- HB 2948 – Corporate income tax phase out over five years.

- HB 2949 – Flat rate 4.25% personal income tax effective Jan. 1, 2024; rate imposed on taxable income amounts above specific figures based on filing status.

- HB 2950 – .25% personal income tax decrease effective Jan. 1, 2024, and following tax years.

- HB 2951 – .25% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

- HB 2952 – .50% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

The Oklahoma legislature has passed some tax reform measures during the past two legislative sessions, including eliminating the franchise tax, allowing full expensing of capital investments for businesses and eliminating the marriage penalty within the state’s individual income tax law.

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers.