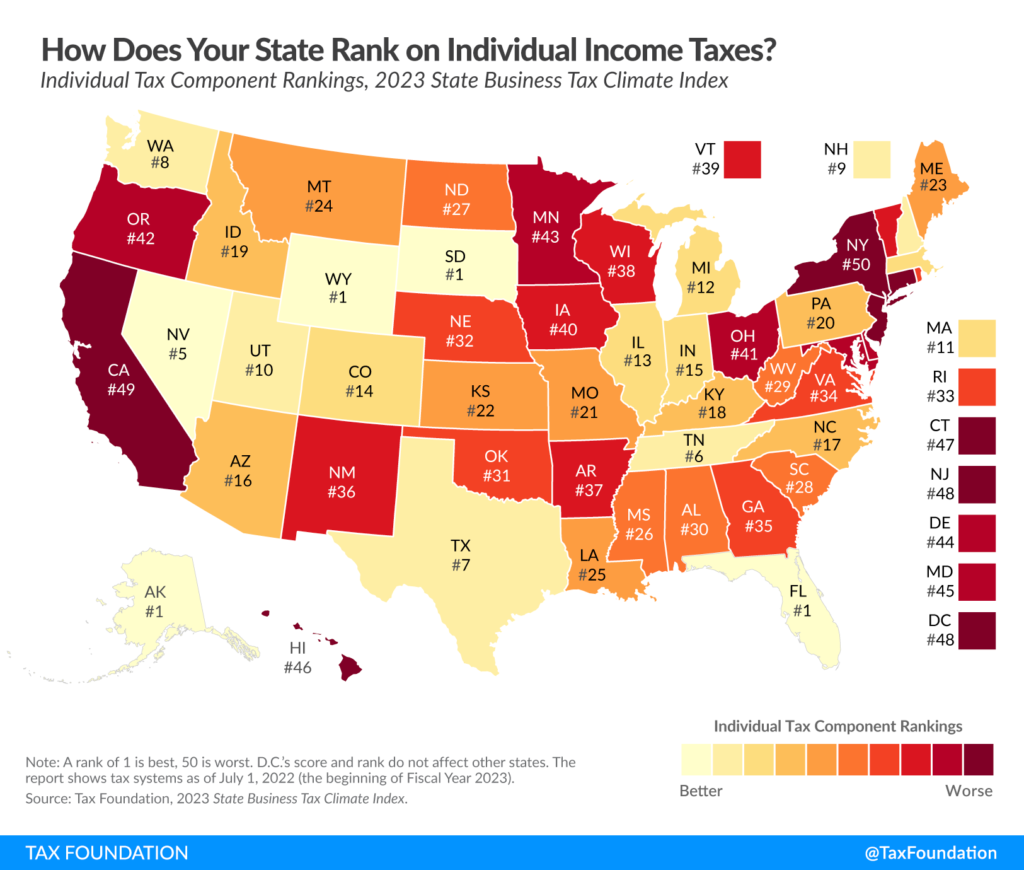

OKLAHOMA (OBV) – Oklahoma continues to languish in the bottom half of the State Business Tax Climate Index’s individual income tax competitiveness rankings.

The 2023 State Business Tax Climate Index ranked Oklahoma 31st in the nation when it comes to individual income tax competitiveness.

The Sooner State’s ranking has seen little change over the past few years, ranking 32nd in 2020, 31st in 2021 and 30th in 2022.

Individual income tax impacts business because it is the tax code by which the state taxes sole proprietorships, partnerships and often limited liability companies (LLCs) and S corporations.

An undesirable individual income tax rate can harm a state’s ability to attract workers, according to Janelle Fritts, columnist for the Tax Foundation, which produces the State Business Tax Climate Index.

“Even traditional C corporations are indirectly impacted by the individual income tax, as this tax influences the location decisions of individuals, potentially impacting the state’s labor supply, and higher individual income taxes increase the price of labor,” Fritts said.

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers. The tax also has a provision that requires married joint filers to pay a penalty if the bracketed income amount does not double for joint filers.

“States that score well on the Index’s individual income tax component usually have a flat, low-rate income tax with few deductions and exemptions. They also tend to protect married taxpayers from being taxed more heavily when filing jointly than they would filing as two single individuals,” Fritts said. “In addition, states perform better on the Index’s individual income tax component if they index their brackets, deductions, and exemptions for inflation to avoid unlegislated tax increases.”

States that do not have an individual income tax, such as Alaska, Florida, South Dakota and Wyoming, ranked high in the State Business Tax Climate Index. States with a single, low individual income tax rate, including Utah, Massachusetts, Michigan, Illinois, Colorado, Indiana, Arizona and North Carolina, also scored well.

A bill was filed in the Oklahoma State Legislature this legislative session to change Oklahoma’s individual income tax.

House Bill 2285, written by Rep. Mark Lepak, R-Claremore, and Sen. Dave Rader, R-Tulsa, consolidates the individual income tax system’s six brackets into one flat rate, while increasing the standard deduction to $10,350 for individual filers – double for married joint filers – to eliminate increased tax liability.

The bill also eliminates the marriage penalty, cuts the rate for all Oklahomans to 4.5 percent and creates a path for future rate reductions, only if revenue conditions are appropriate for additional cuts.