OKLAHOMA CITY (OBV) – A bipartisan gathering of legislative leaders celebrated Gov. Kevin Stitt’s signing of a bill that cuts the state’s grocery tax, each leader saying the tax cut will help all Oklahomans.

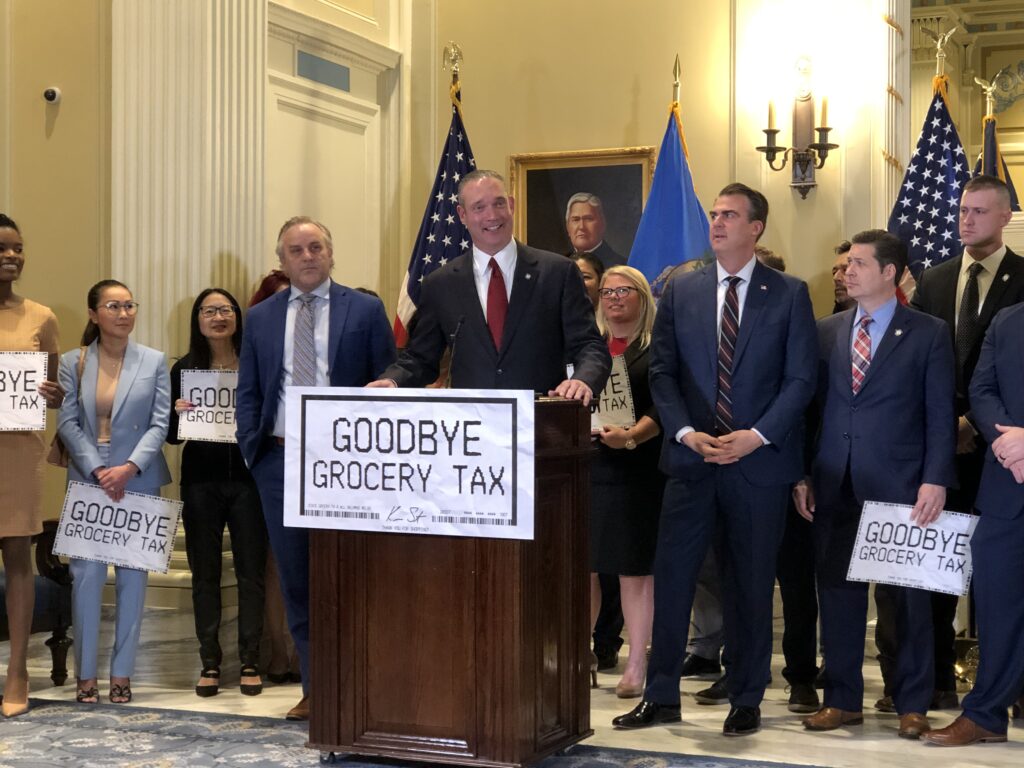

Stitt signed House Bill 1955 in the State Capitol’s Blue Room on Tuesday. He was surrounded by Republican and Democratic leaders of the Oklahoma Senate and House of Representatives, as well as supporters holding signs proclaiming “GOODBYE GROCERY TAX” in store receipt font.

“It’s a kind of a team effort to get this across the finish line. This has been in the making for four years now, and I’m proud of the bipartisan support that made this possible,” Stitt said. “Bipartisan support doesn’t happen every single day, as you might imagine, but every single Republican except for one voted for this bill. And every single Democrat except for one person voted for this bill in the Senate as well.”

HB 1955 succeeded in the Senate with a vote of 42-2 on Thursday. The House of Representatives passed the legislation – written by House Speaker Charles McCall, R-Atoka, and Senate President Pro Tempore Greg Treat, R-Oklahoma City – 11 months ago during last year’s legislative session.

Oklahoma’s state sales-tax rate, which is placed on grocery and other retail purchases, is 4.5 percent. The bill eliminates the tax on all foods that are not prepared fresh in stores.

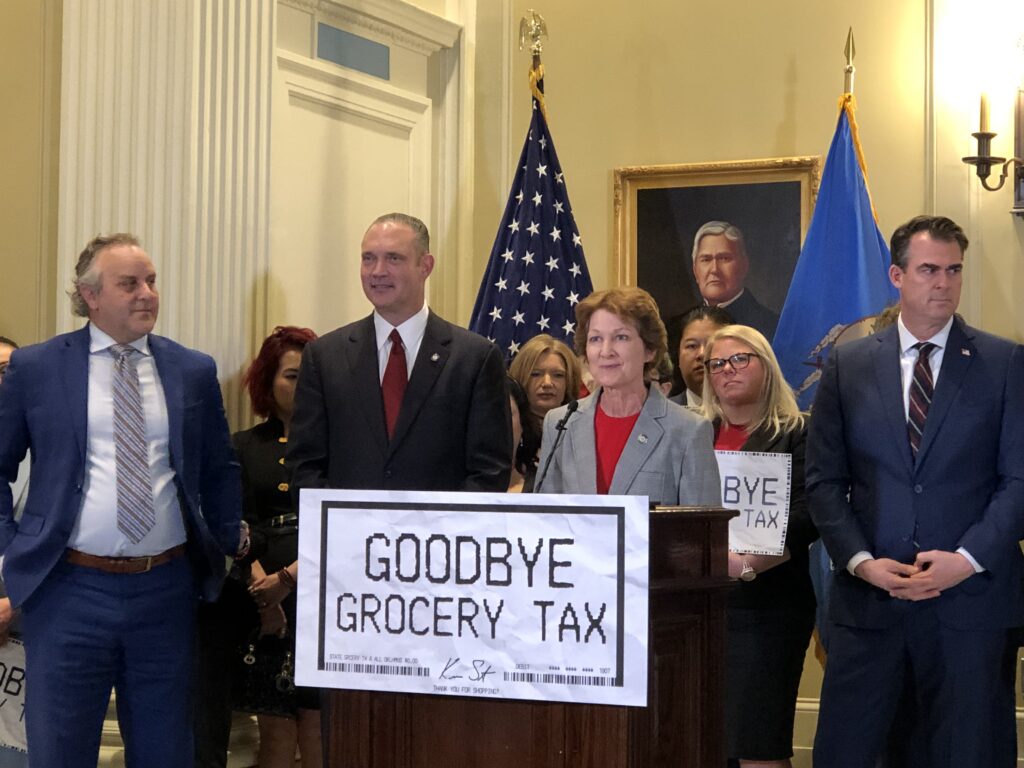

“If you have to go prepare it at home, then you’ll get sales tax relief on the state portion,” Senate President Pro Tempore Greg Treat, R-Oklahoma City, said during the ceremony.

McCall and Treat stood next to Stitt as he delivered his celebratory remarks. Stitt acknowledged Senate Minority Leader Kay Floyd, D-Oklahoma City, House Minority Leader Cyndi Munson, D-Oklahoma City, and Senate Minority-Elect Julia Kirt, D-Oklahoma City, thanking each for supporting the bill.

“To us and leadership, the grocery tax was one of the most regressive taxes that we had. It affected people in the lower income bracket much more than people that made a lot of money, so this was really bipartisan support,” Stitt said. “I think a lot of us were all on the same boat because we have experienced high inflation, which means prices were higher and things were costing more at the grocery store for every single Oklahoma family.”

Stitt said he has been speaking about eliminating the grocery tax since 2019.

“We deliver on that promise today by signing the largest single year tax cut in Oklahoma history,” Stitt said. “We’re going to be delivering on real relief for real Oklahoma families.”

Treat also said that the tax cut is a significant moment in Oklahoma history.

“We’re only one of 13 states that tax groceries. We’re one of five states that tax it at the maximum rate on sales tax. We’re eliminating that state portion today and that’s a huge, huge deal,” Treat said. “It’s a tax cut that will impact more Oklahomans than any other tax cut we can potentially address.”

McCall also said that the tax cut would benefit all Oklahomans.

“Regardless of political party, that’s what we’re here to see,” McCall said. “As the governor mentioned, this is a really big tax to eliminate. I’m thankful that our economy is in the position that it is – being predicted to be the fifth best performing economy this year – we can do these things and help people, and we know that revenue is going to come right back to the state because we are providing inflation relief to the people.”

McCall thanked Stitt and Treat as well as the legislature’s minority leaders, Floyd and Munson.

Munson and Floyd both spoke during the ceremony, adding to the ceremony’s jovial and celebratory mood.

“It’s not everyday that we get invited to press conferences like this, so we’re going to celebrate today,” Munson said.

Stitt playfully placed his arms around Munson’s arms, saying, “Just vote with me more and you’ll be here.” Munson laughed and replied, “We’ll see about that.”

Following laughter, Munson acknowledged Stitt’s determination to get the grocery tax cut signed into law.

“I do want to thank you, Gov. Stitt, for making this a priority. In the 2022 State of the State [address], this is the issue you mentioned that got all of us standing up, so thank you for your leadership on this,” Munson said.

Munson lauded the bipartisanship that went toward cutting the grocery tax as well as past legislative efforts.

“There are leaders that have come before me who have made eliminating the state’s sales tax on groceries a priority for many, many years,” Munson said. “I want to applaud (former Minority) Leader Emily Virgin, who is my predecessor, who held an interim study in the House of Representatives just a few years ago, really getting serious discussion around this issue.”

Munson said protecting the state’s revenue base will remain a priority for House Democrats.

“We’ve got to make sure we have revenue coming into the state so we can make sure critical services that are so important to Oklahomans are taken care of,” she said.

Cutting the grocery tax was a priority Munson said.

“We also know that Oklahomans all across the state are suffering when it comes to inflation costs and high cost of basic necessities like their groceries, and so we had to prioritize this issue,” she said. “We are so happy today to join our colleagues across the aisle and Gov. Stitt to celebrate what we know will help so many working Oklahomans.”

Floyd said Senate Democrats have supported tax reform for years.

“It’s gratifying to see a bipartisan effort start with something so large and so important to the state with the grocery tax elimination,” Floyd said.

Senate Democrats will continue working toward bipartisanship and exploring tax relief opportunities, including potential income tax cuts, Floyd said.

“Reform is critical. We can’t just pick and choose. We need to look at the tax system that we have in the state with a holistic view and start reform – bipartisan, hopefully – just like we did with this,” Floyd said.

The Board of Equalization recently certified $13.9 billion in authorized funds for the Oklahoma Legislature, including $11.1 billion in reoccurring funds and $2.8 billion in one-time funds. Stitt touted the available funds and pushed for the Senate to pass the grocery tax cut and once again called for an income tax cut.

Stitt has repeatedly pushed for income tax cuts, even calling two special sessions – one in September and one before the start of the 59th Legislature.

Treat has clashed with Stitt over tax cuts, having adjourned the Senate on the first day of the last two special sessions. He said both times that it would be irresponsible to pass tax cuts before knowing how much in authorized funds the legislature would have.

The pro tem announced last week that the Senate would pass the grocery tax cut, but said at the time that the Senate would not pass any other major tax cut this legislative session.

Stitt, Treat and McCall were asked during the ceremony about cutting the income tax this legislative session.

“We think we need to put Oklahoma on the path to zero. Like I’ve said always, when you have excess revenue, what are you going to do with that excess revenue? We’re going to modestly grow government, we have to fund core services,” Stitt said. “I appreciate what Cyndi Munson said, that we would never put Oklahoma in a bad situation. We know we have core services, we know we have roads and bridges and we have infrastructure, but we need limited government. We don’t need to continue just to grow government to meet whatever revenue you have.”

Stitt said he hopes to gradually give income tax cuts to Oklahomans.

“I think over the next 10 years, if we keep growing in the trajectory that we are. Maybe we can do it quicker, maybe we can do it in five years,” Stitt said. “But if we don’t keep up with the states around us, we will get left behind.”

Treat said the Senate passed the maximum tax relief they believed possible based on the authorized funds certified by the Board of Equalization.

“What I said I meant, that we went to what we think is the maximum [tax cut] that we could do this year and deliver it early,” Treat said. “We live with the numbers out of the Board of Equalization. We have in the process and the people who make those decisions; we used that to make the best decision on this tax relief.”

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers.

The push for tax cuts in the 59th Legislature began earlier this month when McCall filed several tax cut bills. Those bills are as follows:

- HB 2948 – Corporate income tax phase out over five years.

- HB 2949 – Flat rate 4.25% personal income tax effective Jan. 1, 2024; rate imposed on taxable income amounts above specific figures based on filing status.

- HB 2950 – .25% personal income tax decrease effective Jan. 1, 2024, and following tax years.

- HB 2951 – .25% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

- HB 2952 – .50% personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

McCall spoke with OBV after the signing ceremony and emphasized the need for an income tax cut. He said it boils down to making Oklahoma more competitive and growing its workforce.

“I think long term, we have to put Oklahoma on a path to get to zero,” McCall said. “Human resources are mobile. Capitol is mobile. When we talk about workforce, every state’s having workforce challenges,” McCall said. “We want to import talent into the state of Oklahoma while we’re grooming and building it ourselves through our youth and through education. When human resources and capitol are looking to go somewhere, they are going to the states where there is no taxation on there productivity. That’s why we got to get to the zero percent personal income tax in the state of Oklahoma.”

The Oklahoma legislature has passed other tax reform measures during the past two legislative sessions, including eliminating the franchise tax, allowing full expensing of capital investments for businesses and eliminating the marriage penalty within the state’s individual income tax law.