OKLAHOMA CITY (OBV) – Oklahoma House Speaker Charles McCall announced a $500 million education package that he says will provide hundreds of millions of dollars to public schools throughout Oklahoma, tax credits to parents and guardians whose children attend private schools and mandatory raises for all teachers.

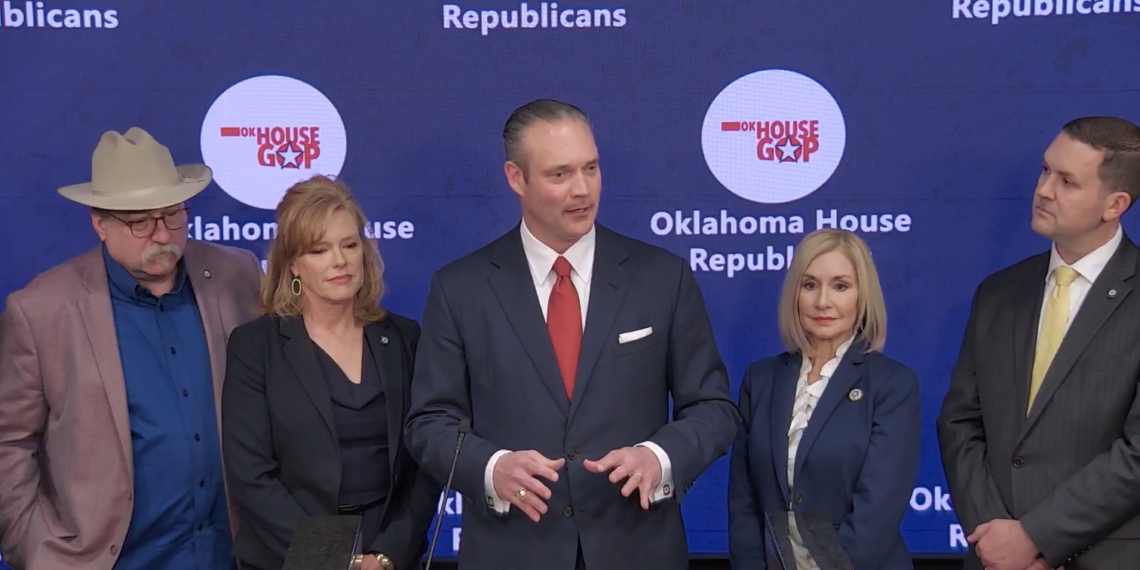

McCall, R-Atoka, outlined the Republican House Caucus package during a news conference at the State Capitol on Thursday.

The House speaker said the education plan supports students, parents and teachers. He also said it will put Oklahoma ahead of Arkansas, even with Florida and just behind Texas in per pupil expenditures, and ahead of Arkansas and Missouri and even with Kansas for average teacher pay.

“The common denominator in all of education are the students. This is an every kid wins policy and funding plan,” McCall said.

The package has Gov. Kevin Stitt’s support, McCall said.

Oklahoma Business Voice reached out to Stitt’s staff for comment. Kate Vesper, Stitt’s press secretary, said the following: “We are encouraged by the House’s momentum to ensure students across Oklahoma can receive a high-quality education.”

The package includes $150 million that will run through a standard school funding formula and can be used to increase teacher salaries.

McCall said the package mandates a $2,500 teacher pay raise, but later said that school districts can choose to give their teachers an annual raise greater than $2,500. School districts can also decide whether they want to use any of the money to give support staff raises.

“They can be used for any wraparound services, such as school counselors, therapists, whatever a local district may need in addressing the educational needs of students,” McCall said.

The $2,500 raise is not based on Oklahoma’s minimum salary schedule, but instead on what the active classroom teacher is making today.

“If they are being paid above the minimum, the schools will be mandated in this plan to pay the teacher $2,500 additional pay on top of what they’re currently earning,” McCall said.

McCall said $50 million will be distributed in a proportional manner to the poorest schools throughout the state, including urban and rural areas.

The remaining $300 million will go into a fund called the Oklahoma Student Fund, which will be spread among all schools across the state, with each school receiving funds based on their average daily student attendance from the previous year, with a $2 million cap per school district.

“These appropriate moneys basically can be used for anything within the academic realm,” McCall said.

McCall said the package does not include vouchers or empowerment scholarship accounts (ESAs), however, it does include the Oklahoma Parental Choice Tax Credit Act, which he said “contemplates a maximum credit of $5,000 per year for private school education costs” and $2,500 for home school costs.

The tax credit can be claimed once a year, split in half for the two school semesters, but will require parents and guardians to provide documentation and proof to claim the credit.

“If you cannot document the full amount, you will not receive the full amount of the credit,” McCall said. “The taxpayer will have to retain all receipts, private school tuition and fees, or qualified expenses of proof of the amount to claim the tax credit.”

The Oklahoma Tax Commission will create a form that will be provided to parents and guardians to confirm private school enrollment and tuition so that they can receive the tax credit.

“If a student claims the credit and transfers to a different school, mid-semester, there will be a clawback provision on the amount of credit that’s issued,” McCall said.

Authorization of the tax credit will be tied to the state’s new level of funding for public education, according to McCall.

“If the future legislature does not fund education going forward at this new base, then the tax credit will be suspended until funding is restored,” McCall said. “The funding going forward – the additional $500 million of this new funding – will also have to be met in the future based on the $150 million into the formula, $50 million that will run through the State Department of Education and applied under the same qualifiers as Redbud, and the $300 million going into a new fund.”

The tax credit is refundable and can be stacked with the Lindsey Nicole Henry Scholarship for special needs students throughout Oklahoma, McCall said.

The $5,000 credit is only for private school students, according to McCall.

“The taxpayer’s child cannot be a full-time student in a public school district, public charter school, public virtual charter school or magnate school,” he said.

The bill includes non-severability language, meaning that if any part of the bill is challenged in court and deemed unconstitutional, it will unwind itself and the legislatures behind it will have to start back from square one, according to McCall.

“In this bill, we are also seeking to tie our entire education communities throughout the state together,” McCall said. “We will ride in this boat together through the good times and through the tough times.”