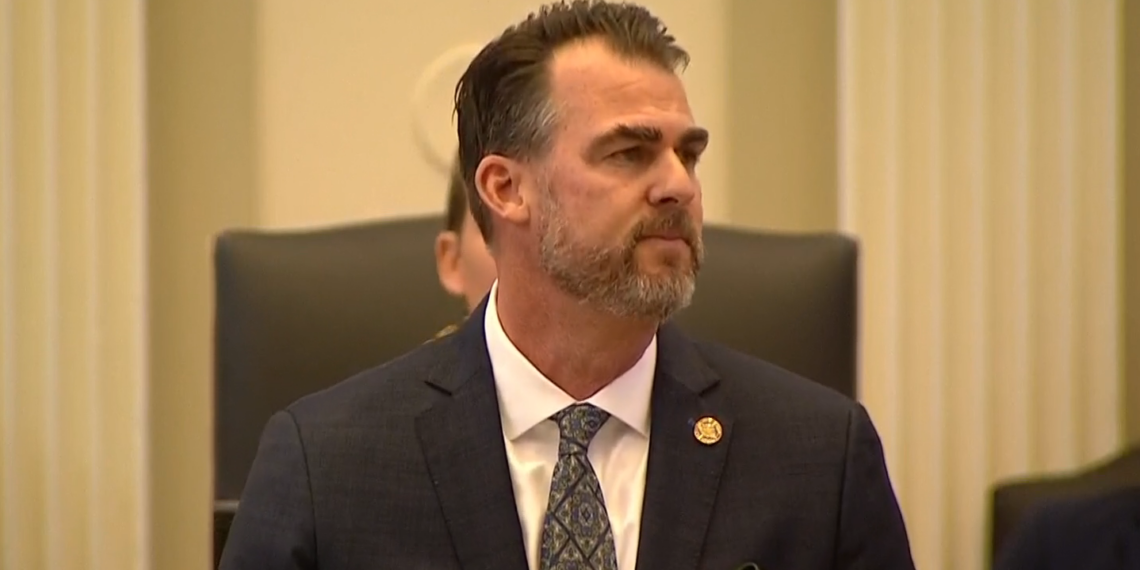

OKLAHOMA CITY (OBV) – Reducing Oklahoma’s income tax and making Oklahoma a top business state were the main focuses of Gov. Kevin Stitt’s State of the State address on Monday. He also announced the creation of DOGE-OK, inspired by President Donald Trump.

“I believe we’re here to pursue something greater than ourselves, something that will show the world what Oklahoma is all about,” Stitt said.

Stitt laid out a vision that includes an income tax reduction plan, making Oklahoma a top business state and joining Trump and Elon Musk’s Department of Government Efficiency (DOGE) initiative.

Stitt reiterated his four focuses for this legislative session, which he announced last week:

- Protect Oklahoma taxpayers;

- Be the best state for business;

- Safeguard Oklahoma’s savings; and

- Protect the Oklahoma way of life.

“These ideas aren’t controversial, but they will require tough choices. They will require sacrifice. They will require that we trust that Oklahomans know how to spend their money better than the government can,” Stitt said. “That we trust that businesses want to make our state better for everyone by creating jobs and investing in their communities. That we can say no to the good now so we can say yes to great later.”

Stitt said Oklahoma must reduce its income tax to compete with other states.

“States all around us – Nebraska, Missouri, Arkansas, Colorado and Louisiana – are cutting their income taxes and have lower rates than we do,” Stitt said. “If we don’t act quickly, we are going to be left behind and we’ll be considered a high tax state.”

The governor said that his goal this year is “a half and a path,” which he described as a half a point income tax reduction from the current 4.75 percent rate to a 4.25 percent rate. He said it’s an action that will start a path towards zero income tax in Oklahoma.

“I like to remind the naysayers when we cut taxes, the money doesn’t disappear; it stays in Oklahomans’ pockets and gets reinvested in our economy,” he said.

Stitt said Oklahoma’s $4.6 billion in savings necessitates an income tax reduction.

“In times of excess revenue, Oklahomans should keep more of their hard-earned money,” he said. “That is how we keep pace with our competition and protect Oklahoma taxpayers.”

Elevating Oklahoma’s business community is key to making Oklahoma one of the most prosperous states in the nation, Stitt said.

“By being the best state for business, we’re paving the way to be the best state for education, the best state for infrastructure and the best state for families,” he said. “Rising tides lift all boats.”

Stitt said he wants to attract top companies looking for a new state to expand into, and key to that is providing those companies a skilled and capable workforce.

“If kids aren’t leaving high school college ready or career ready, we haven’t done our job,” Stitt said.

The governor said he is taking action to provide that workforce through more apprenticeships and internships.

“I want to sign a bill that creates more internships and apprenticeships,” he said. “If we can get this right, we’ll lead the nation in workforce development. Companies from all around the world will move operations to Oklahoma because it’ll be clear that we have the strongest workforce anywhere. So, I’m calling on businesses, schools and universities to create 250 new apprenticeship and internship programs this year.”

Stitt also touted the creation of business courts in Oklahoma.

He said the passage of Senate Bill 473 last year, which pursues the creation of business courts, will show major companies looking to expand into a new state that Oklahoma is a place where companies receive fair and expedient treatment in the courts. Business courts will specialize in resolving intricate commercial disputes in a fast, efficient manner that is cheaper for businesses.

State Chamber of Oklahoma President & CEO Chad Warmington issued the following statement in support of Stitt’s plan for growing business in Oklahoma:

We fully support Governor Stitt’s vision that Oklahoma’s strength lies in its thriving business environment, and we are encouraged by his renewed commitment to our shared vision of making Oklahoma the best state in America to start, run, and grow a company. The governor’s call to increase career readiness for Oklahoma students, as well as highlighting the importance of internships and apprenticeships, is an important step to increasing workforce participation. It is essential that Oklahoma’s schools and businesses work together to create more of these valuable opportunities, ensuring our state’s workforce is prepared for the challenges and opportunities ahead.

Business courts can be a valuable asset to Oklahoma. A venue where business disputes can be decided swiftly and fairly is vital so that businesses can spend more time doing what they do best, innovating and investing in their communities, not getting caught up in a courtroom.

As Oklahoma’s leaders evaluate potential tax cuts this session, we encourage them to prioritize reforms that will enhance the competitiveness of the state’s tax code. By doing so, we can unlock opportunities for economic growth and development, all while ensuring a balanced and sustainable approach to tax reform.

Chad Warmington

Stitt also announced his DOGE-OK plan.

Trump appointed billionaire Musk and entrepreneur Vivek Ramaswamy to lead DOGE, which will not be an actual federal department, despite the word “department” being part of its name, but instead serve as an advisory committee designed to save taxpayers money.

“President Trump and Elon Musk, through DOGE, will determine the economic trajectory of our nation,” Stitt said. “By cutting the size of the federal government, we can finally start having an honest conversation about our nation debt.”

Stitt said he visited Mar-a-Lago recently and talked to Trump about a state-level version of DOGE.

“I’m excited about the momentum behind DOGE, and we’re going to build on it here in Oklahoma,” he said. “Today, I’m launching DOGE-OK to keep focus on flat budgets and limited government.”

Stitt also called for educational reforms, including eliminating virtual days and prohibiting cell phones in classrooms.

He said some Oklahoma school districts require that students be in the classroom only 148 days a year. He compared that number to Kansas, which requires students be in school 186 days a year.

“We all know that kids learn best when they’re in the classroom,” Stitt said. “It’s just common sense.”

Cell phones are a distraction to the educational experience and should not be in classrooms, Stitt said.

Stitt challenged school districts to come up with phone-free classroom plans last fall.

He praised Bixby Public Schools Superintendent Rob Miller for implementing a cell phone free classroom policy after noticing a decline in academic performance among his students. Miller has since seen a drastic improvement in student performances.

Stitt wants other schools to follow suit.

“I want to challenge the legislature and school districts across the state to consider ways to make cell phone free schools a reality for all students,” Stitt said.

Oklahoma’s legislative leaders issued the below statements in response to Stitt’s State of the State address.

Senate President Pro Tem Lonnie Paxton:

“Governor Stitt laid out his vision and outlined a plan to move Oklahoma forward in a positive trajectory that we can all agree with,” Pro Tem Paxton said. “The Senate shares his commitment to growing our economy, improving education, ensuring safe, thriving communities and improving the lives of Oklahomans by allowing them to keep more of their hard-earned money.

This session, the Senate looks forward to working alongside the governor and our colleagues in the House to advance policies that will strengthen our workforce, create new opportunities for business investment and make strategic investments in core services. By working together, we can build a stronger, more prosperous Oklahoma for generations to come.”

Oklahoma Senate Pro Tem Lonnie Paxton

House Speaker Kyle Hilbert:

“I look forward to working with Gov. Stitt and Pro Tem Paxton to enact many of the priorities the governor discussed today. We all agree in wanting Oklahoma taxpayers to keep as much of their hard-earned money as possible while being as prepared as possible for future budget uncertainty. We will continue budget discussions in earnest once we have final FY26 numbers from the Board of Equalization.

Finding government efficiencies with an Oklahoma version of DOGE is a shared priority and will be critical as we seek to tighten our belt fiscally this year. We are all on the same page that we need to ban cell phones in schools with local implementation and, as a father of young kids myself, I applaud the Governor’s continued focus on fatherhood and building up Oklahoma families.

We have a lot of challenges ahead, but we are united in wanting to make Oklahoma better for future generations. That work officially begins today.”

Oklahoma House Speaker Kyle Hilbert

House Democratic Leader Cyndi Munson:

“The Governor’s address did not make me confident that he is prioritizing Oklahomans who are relying on us to find solutions to the financial challenges they face. He is prioritizing DC-style politics and talking points rather than the overwhelming needs of Oklahomans who have had to go session after session not seeing solutions that work for them.

The Governor’s tax plan helps the wealthy, not the everyday working Oklahoman. House Democrats are focused on targeted financial relief for those who need it most and protecting revenue to fund core functions of state government. We are focused on lowering costs for working families by: modernizing and expanding the Sales Tax Relief Credit, expanding the Earned Income Tax Credit, raising the minimum wage, making childcare affordable, and providing free school lunch for students.We believe that living should cost less between paychecks, that every child deserves free, quality public education, and that we all have the best chance of success when we’re healthy and have access to the care that we need. Oklahomans deserve leaders focused on making that possible.”

Stitt said last week that he hopes to gradually give income tax cuts to Oklahomans.

“What people don’t realize is when we give money back to the taxpayer, the money doesn’t disappear. It just stays in the citizens pockets. And I believe that they can spend their money better than the government can,” Stitt said. “We need to give that money back to the taxpayers in the form of a tax cut. We’ve done it before.”

The state income tax was created statutorily in 1915.

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income. The state also has a 4.0 percent corporate income tax rate.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers.

Stitt has repeatedly pushed for income tax cuts. He called two special sessions last year – one in September and one before the start of the 59th Legislature – hoping that the legislature would move an income tax cut initiative forward.

However, former Pro Tem Greg Treat stymied Stitt’s income tax hopes, adjourning the Senate on the first day of both special sessions. He said both times that it would be irresponsible to pass tax cuts before knowing how much authorized funds the legislature would have.

Stitt, Treat and Former Oklahoma House of Representatives Speaker Charles McCall worked together to cut the grocery tax in February, but Treat did not budge on his opposition to cutting the income tax.

McCall filed several tax cut bills during last year’s legislative session. Those bills called for the following:

- Corporate income tax phase out over five years.

- Flat rate 4.25 percent personal income tax effective Jan. 1, 2024; rate imposed on taxable income amounts above specific figures based on filing status.

- .25 percent personal income tax decrease effective Jan. 1, 2024, and following tax years.

- .25 percent personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

- .50 percent personal income tax decrease for 2024 and 2025, with rates to restore to current level (current rates and brackets) for 2026, and following tax years.

Paxton sat down with Oklahoma Business Voice for a one-on-one interview and said that reducing the income tax is a top priority for the 2025 legislative session.

However, none of those bills succeeded.

A new income tax bill has already been filed for this legislative session.

Rep. Jay Steagall, R-Yukon, filed House Bill 1009 in December. The bill seeks to reduce the personal income tax rate by 0.00475 percent annually and the corporate income tax rate by 0.004 percent annually over 10 years. He filed a nearly identical bill for consideration during the 2024 legislative session.

“Recent polls show that Oklahomans overwhelmingly support the elimination of the state income tax, an effort for which I have filed legislation in the past two years and filing once again for the 60th Legislature,” Steagall said. “The state income tax is a clear violation of our own state constitution and I will continue to pursue righting this wrong in the upcoming session.”