OKLAHOMA CITY (OBV) – Gov. Kevin Stitt put on a Power Point presentation this week to push his priority income tax cut plan, “A Half and a Path.”

Stitt entered 2025 with income tax cuts on his mind. The governor said from the start of the year that cutting the income tax is one of his top priorities for 2025.

The governor said that his goal this year is “A Half and a Path,” which he described as a half a point income tax reduction from the current 4.75 percent rate to a 4.25 percent rate. He said it’s an action that will start a path towards zero income tax in Oklahoma.

“I like to remind the naysayers when we cut taxes, the money doesn’t disappear, it stays in Oklahomans’ pockets and gets reinvested in our economy,” he said earlier this year.

Stitt reiterated his want for an income tax cut during his weekly news conference on Wednesday, saying Oklahoma is in an economically viable position to cut the income tax.

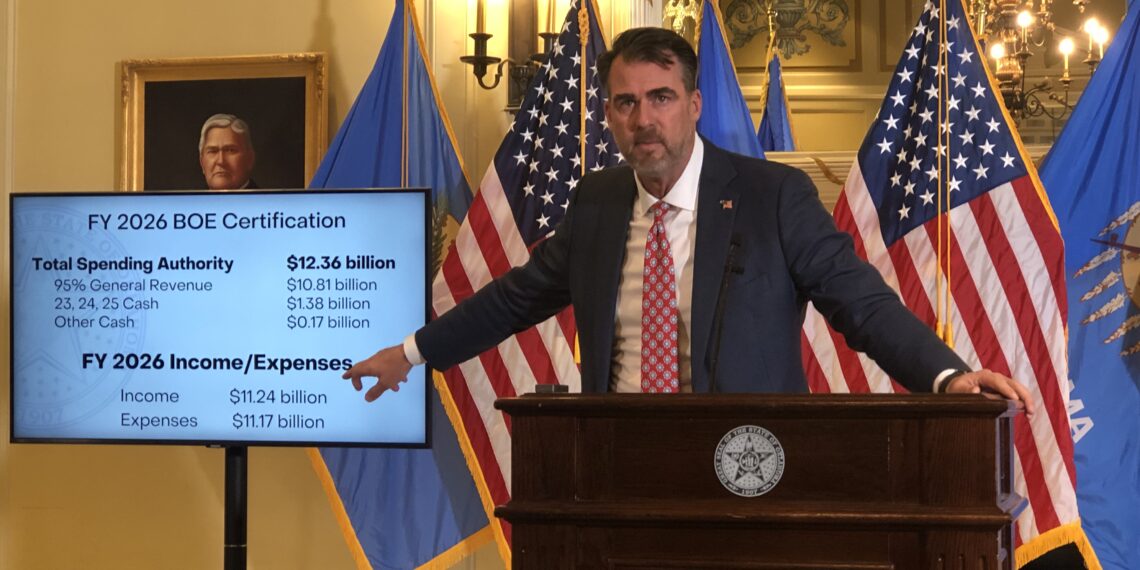

The governor started off the Power Point by emphasizing the state’s $11.24 billion in income from all revenue sources and $11.17 billion in expenses for 2026.

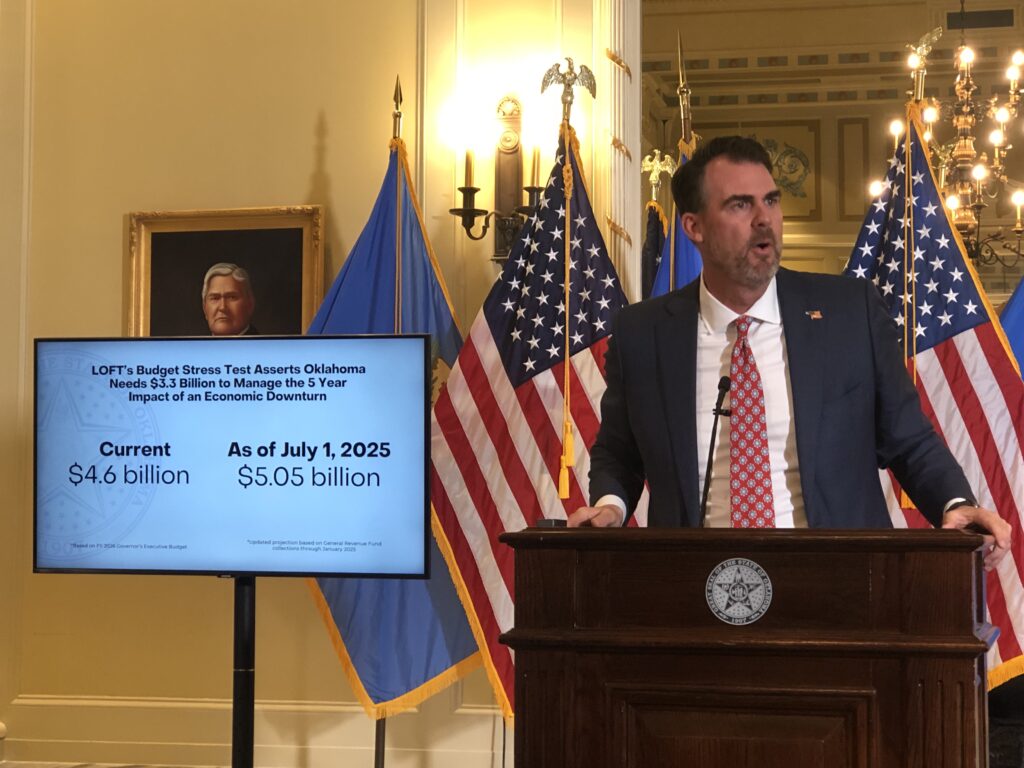

He then touted Oklahoma’s $4.6 billion in savings.

“When I took office as a businessman governor, we had no money in savings. I thought it was really important that we develop a healthy savings account so we could weather a downturn, because revenue doesn’t always go up in a straight line,” Stitt said.

Stitt projected that Oklahoma will have $5.05 billion in savings by July 1, which is right after the end of the current fiscal year.

Oklahoma’s billions of dollars in savings necessitates an income tax reduction.

“There’s a lot of great things that we can do in this state [with this money] and the legislature’s working on that. But we have to do a tax cut,” he said.

A tax cut doesn’t mean that hundreds of millions of dollars will be cut from the state government, Stitt said.

“It means that Oklahomans are going to receive a pay raise. They’re going to keep more money. It’s their money in the first place,” he said.

Stitt asserted that tax cuts result in revenue expansion. He said Oklahoma’s revenue has steadily increased since 2004 when the state had a 7 percent income tax.

“Because people feel better about themselves. Oklahomans have more money in their pocket. It means they go to restaurants and they go to the grocery store and they spend more money on their children. Businesses feel better because they’re getting more customers. They’re hiring more people. That money spends in the economy,” Stitt said.

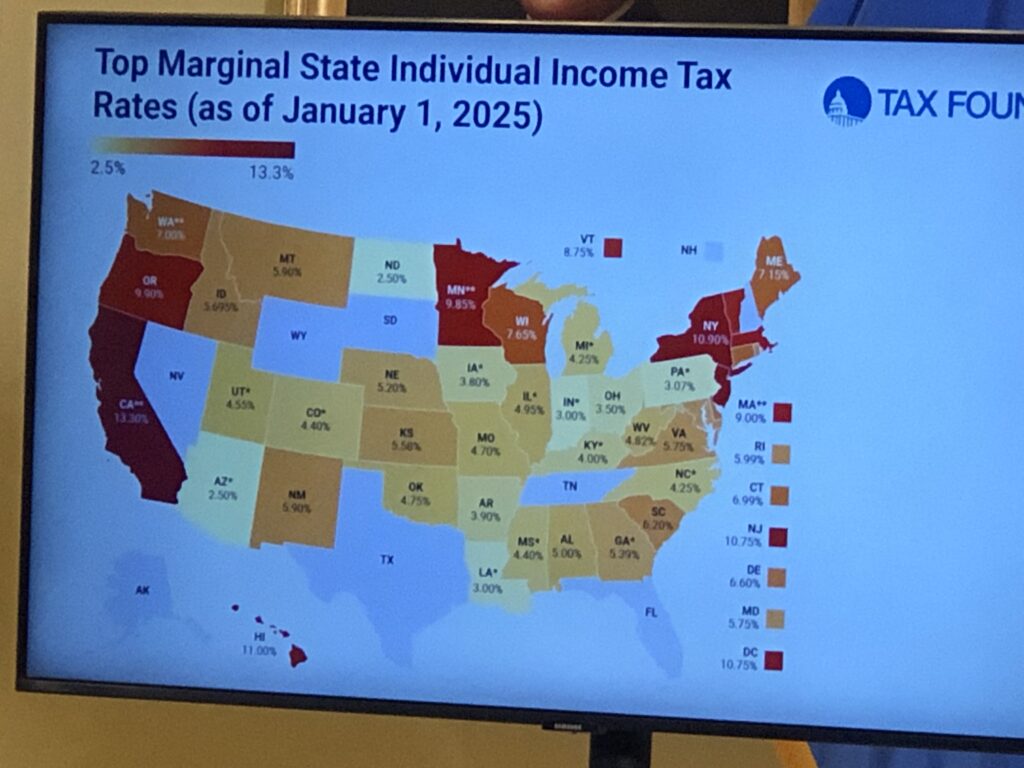

He also argued that the income tax has to be cut to help Oklahoma compete against other states when it comes to attracting major companies looking to expand.

“When we recruit companies to Oklahoma, they’re asking about our workforce, they’re asking about our tax policy, they’re asking about a lot of things,” Stitt said. “If we do not cut taxes and stay up with our competition, we’re going to be an outlier when it comes to tax policy.”

Stitt referenced Texas’ zero percent income tax, Mississippi cutting its income tax to 4 percent on a path towards zero, South Carolina dropping from 6.2 to 3 percent and Arkansas reducing its income tax to 3.9 percent, as well as many other states with a lower income tax than Oklahoma.

“We can absolutely do it. And I’m not saying we’re going to do it overnight. But I’m saying [we can] do just a little bit each year and we can take a pause until revenue continues to grow,” he said. “There’s nothing like the present.”

Oklahoma’s individual income tax system has six income tax brackets ranging from 0.5 percent to 4.75 percent for top earners. The 4.75 percent rate kicks in at a $7,000 annual income. The state also has a 4.0 percent corporate income tax rate.

All Oklahomans and more than 95 percent of businesses in the state pay the individual income tax. The income tax’s standard deduction is $6,350 for single filers and $12,200 for joint filers.

Stitt has repeatedly pushed for income tax cuts. He called two special sessions in 2023 – one in September and one before the start of the 59th Legislature – hoping that the legislature would move an income tax cut initiative forward.

However, former Pro Tem Greg Treat stymied Stitt’s income tax hopes, adjourning the Senate on the first day of both special sessions. He said both times that it would be irresponsible to pass tax cuts before knowing how much authorized funds the legislature would have.

Stitt, Treat and former House Speaker Charles McCall worked together to cut the grocery tax in February 2024, but Treat did not budge on his opposition to cutting the income tax.

Senate Pro Tem-elect Lonnie Paxton sat down with Oklahoma Business Voice for a one-on-one interview and said that reducing the income tax is a top priority for the 2025 legislative session.