OKLAHOMA CITY (OBV) – The State Chamber of Oklahoma is championing workforce, education, childcare, tort reform and tax reform bills this legislative session in its ongoing mission to make Oklahoma one of the top business states in the nation.

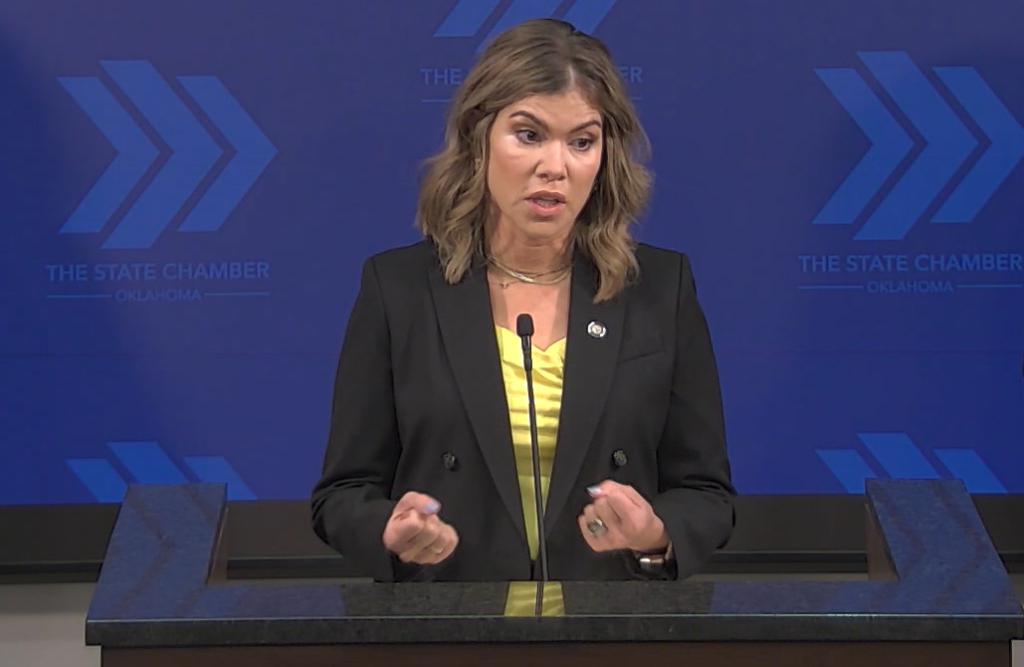

The bill announcements were made during a news conference at the State Capitol Thursday morning.

Emily Crouch, the Chamber’s senior vice president of Government Affairs, was joined by Rep. Suzanne Schreiber, D-Tulsa, Rep. Erick Harris, R-Edmond, Sen. Ally Seifried, R-Claremore, Rep. Brian Hill, R-Mustang, and Rep. Gerrid Kendrix, R-Altus, to unroll the Chamber’s legislative agenda.

“There are three main pillars for our agenda this year: workforce development, tort reform, and tax policy. All these pillars have legislation that are going to help businesses across the state as well as every industry,” Crouch said.

This year, the Chamber has a four-pronged approach to growing the workforce. The four prongs are as follows:

- Championing greater investment in the Oklahoma Workforce Commission, the creation of which the Chamber supported in 2023.;

- Eliminating barriers and liability to enable businesses to provide experimental work-based learning (apprenticeships/internships) to Oklahoma students;

- Changing the state’s A-F Report Card to improve career-readiness education for K-12 students and schools; and

- Creating a tax incentive for employers who support their workers’ childcare needs, whether by providing on-site childcare, reserving space at local childcare centers or offering employees financial assistance for out-of-pocket childcare expenses.

Hill, who chairs the House Commerce and Economic Development Oversight Committee, co-authored Senate Bill 662 and Senate Bill 663 with Sen. Adam Pugh, R-Edmond. Both are Chamber-supported bills that were created to support the Workforce Commission’s efforts to revitalize the state’s workforce.

“[The bills] give the Oklahoma Workforce Commission the resources and direction it needs to accomplish its mission of analyzing the state’s workforce needs while ensuring it is also collaborating on solutions,” Hill said.

SB 662 establishes program lanes that will help guide the Workforce Commission.

“These lanes will define target areas of focus and encompass all aspects of education and our workforce systems, which are vast,” Hill said. “When you ask the question of who owns workforce in the state, you had over 30 different agencies that would raise their hand. Now we’re starting to see a correlation of us connecting all of those pieces together.”

SB 663 moves the revolving fund that was previously set up for workforce development and housed at the Department of Commerce to the the Workforce Commission, which was the ultimate goal for the fund when it was originally established.

“As a business owner myself, I all to well understand how crucial workforce needs are for businesses in our state. You can’t create a thriving business without a strong workforce,” Hill said. “We need to support our education and workforce system with the tools and resources they need to collaborate and meet out demand.

Together we can build a stronger future for our children, for our families, and for our communities. Standing together, we will move Oklahoma forward.”

Seifried, who serves vice chair of the Senate’s education committee, introduced Senate Bill 95, which she wrote, and Senate Bill 711, which was written by Pugh.

SB 711 changes the state’s A–F Report Card to focus on improved career readiness for K–12 students.

SB 95 aims to expand work-based learning by eliminating barriers and liability for businesses providing experimental learning for Oklahoma students.

“As a small business owner, something my family and I talk about often is trying to find people who are ready and have the skills to meet the needs that we have. We think [SB 95] is a really strong signal to try and share with businesses to open up those work-based learning experiences and internships,” Seifried said.

Some business owners are reticent to incorporate work-based learning in their business because they don’t know if the apprentice or intern would be covered by workers compensation insurance.

“We’ve clarified that here and we think this really can be a really good opportunity to try to open up some opportunities for our students and businesses that are struggling with trying to run their business, find employees and support the future workforce,” Seifried said.

Seifried said SB 95 ties in some of the graduation requirements the legislature passed last to expand work-based learning and help students be career-ready out of high school.

“We’re hoping this can spur some growth and some opportunities for students,” she said.

The State Chamber sees accessible and affordable childcare as a key component of growing the workforce. Three bills – House Bill 1848, Senate Bill 104 and Senate Bill 256 – were filed to expand childcare access by giving tax credits to employers who help their employees obtain childcare.

Schreiber, who has fought for years for childcare reform, authored HB 1848 and co-authored SB 256.

“Parents are employees. They need childcare. All the things we’re working on at the Capitol start with childcare – a healthy, safe, affordable, accessible childcare system,” said Schreiber.

Schreiber filed a childcare tax incentive bill last year, but the bill did not fully clear the legislature before the 2024 legislative session was over.

“We’ve spent three years working on this. Businesses have not changed their tune. They are desperate to get these improvements. They are desperate to make sure their employees have what they need. They are desperate to find those employees that are staying home because they cannot afford or cannot find childcare that they need,” Schreiber said. “So, we are here with this solution, and I look forward to getting it done this year.”

Tort reform is another top focus for The State Chamber.

Senate Bill 625 and House Bill 2619 seek to bring greater transparency to the judicial system to prevent unethical legal maneuvering and exploitation by third parties who fund lawsuits against businesses. Also, Senate Bill 642 and Senate Bill 1013 aim to protect businesses and their contractors from undue liability and government intrusion into private contracts.

Harris, an attorney and author of HB 2619, introduced the bills.

“We can often talk about wanting to make Oklahoma a top 10 state for business growth and development, but you have to have a regulatory structure in place that supports that. And that’s what this legislation does. This legislation on third-party litigation financing would allow the disclosure of third-party litigation funding,” Harris said. “What we are concerned about is a concerted effort by some individuals and some entities to influence the business community by recruiting individuals to engage in frivolous litigation. Studies have shown that there’s about $3.7 billion in gross product that is lost each year in Oklahoma due to frivolous litigation. This third-party litigation funding bill would allow us to see through transparency if there are those concerted efforts to influence courts.”

The State Chamber is supporting tax reform measures that Chamber officials say will make Oklahoma’s tax code one of the most competitive in the country for businesses and individuals.

The Chamber is supporting Senate Bill 304, which simplifies the individual income tax brackets, making Oklahoma more competitive for businesses looking to expand.

House Bill 1200 and Senate Bill 60 are also key parts of the Chamber’s tax reform agenda. Those bills modernize the corporate income tax by eliminating outdated procedures used to determine a business’ overall tax liability.

Kendrix, an account and tax reform proponent, spoke about how the bills will make Oklahoma more competitive when it comes to attracting top companies looking to expand.

“A couple of the major things businesses look at in coming into a state is [does the state] have a stable regulatory structure [and] a stable tax structure where they know what they can expect,” Kendrix said.

Oklahoma uses a three-pronged apportionment formula to calculate corporate income tax. The apportionment formula consists of sales, payroll and property weighted equally.

“When it does that, we wind up having our state businesses that are here inside the borders of the state paying more, based on the fact that they have assets and payroll in the state, than someone just across the state line,” Kendrix said. “So, it could encourage a business to move just across the state line and still operate in Oklahoma.”

HB 1200 and SB 60 seek to replace the three-pronged apportionment formula with a single-sales factor formula.

SB 304 moves Oklahoma from a six-bracket tax code to a single bracket.

“We believe that is a streamlining of the tax code because now we will have one rate, and any time we want to do a tax cut of any sort, this will allow us to do a tax cut that affects everybody equally,” Kendrix said.